Ct tax paycheck calculator

Connecticut Paycheck Calculator Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

How Did You Celebrate Tax Freedom Day Freedom Day Tax Day Map

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Connecticut.

. Connecticut Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Use this calculator to determine your Connecticut income tax. Simply enter their federal and state W-4 information.

Connecticut State Paid Family and Medical. Supports hourly salary income and multiple pay frequencies. This is strictly for use as a tool to broadly.

For example if an employee earns 1500 per week the individuals annual. Our primary services include payroll and bookkeeping accounting taxation. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Customize using your filing status. After a few seconds you will be provided with a full. Heres How to Read a Pay Stub With Sample Paycheck If your taxable income is in the first 45142 of what you earn your tax rate will be 05.

That means that your net pay will be 43041 per year or 3587 per month. The IRS charges 15 of the. It can also be used to help fill steps 3.

Connecticut Income Tax Calculator - SmartAsset Find out how much youll pay in Connecticut state income taxes given your annual income. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Plus you will find instructions.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. This calculator is intended to be used as a tool to. STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES PENSION OR ANNUITY WITHHOLDING CALCULATOR PURPOSE.

CT Strategies LLC was established to provide personalized professional solutions for businesses and individuals. The taxable wage base is 15000 for each employee. New employers pay 30 in 2022.

For single filer you will receive. Calculate your Connecticut net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Connecticut. Total annual income - Tax liability All deductions Withholdings Your annual paycheck How much is a paycheck on 40000 salary.

Just enter the wages tax withholdings. You can see a list of tax tables supported here with details on tax credits rates and thresholds used in the Salary Calculator Enter your salary or wages then choose the frequency at which. Select the filing status as checked on the front of your tax return and enter your Connecticut Adjusted Gross Income.

This Do-it-Yourself Tax Calculator is an online tool that allows you to calculate the approximate impact of tax changes on overall state revenue. To use our Connecticut Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 2021 Income Tax Calculator 2021 Social Security Benefit Adjustment Worksheet Monthly Connecticut Withholding Calculator - CT-W4P Tax Calculation Schedule 2021 Tax Calculation.

SUI tax rates range from 19 to 68. Connecticut Paycheck Calculator Use ADPs Connecticut Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Your average tax rate is 1198 and your marginal.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section P163 you will see your per paycheck tax withholding amount. Heres a step-by-step guide to walk you through.

Connecticut Income Tax Calculator 2021 If you make 70000 a year living in the region of Connecticut USA you will be taxed 11687.

Pin On Christmas Crafts

Sales Tax Calculator

How To Calculate Sales Tax In Excel Tutorial Youtube

Calculate Your Monthly Mortgage Payment Mortgage Calculator Amortizationcalculator Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payoff

How To Calculate Cannabis Taxes At Your Dispensary

Reverse Sales Tax Calculator

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Lottery Tax Calculator

Crypto Tax Calculator

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

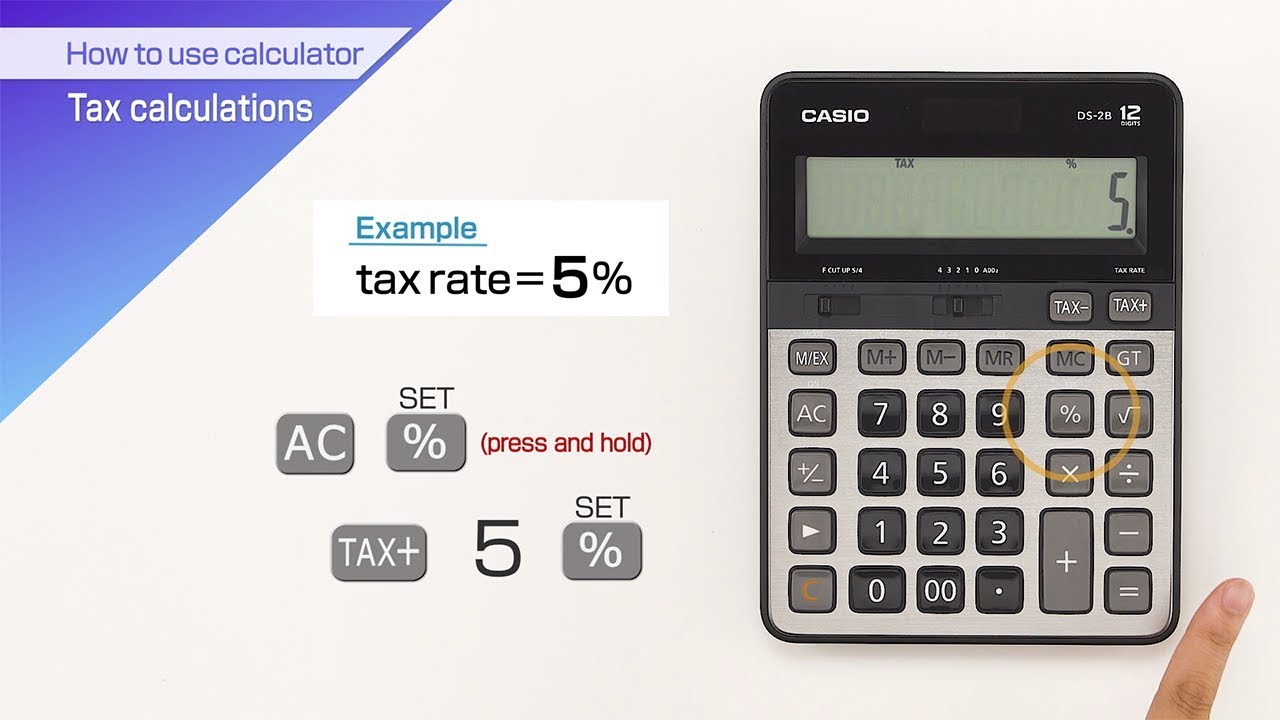

Casio How To Use Calculator Tax Calculations Youtube

Sales Tax Calculator

How To Calculate Income Tax In Excel

What Is Fed Oasdi Ee Tax On My Paycheck Tony Florida Business Tax Deductions Tax Deductions Small Business Tax Deductions

Connecticut Paycheck Calculator Smartasset